Venture Capital Investment in the Life Science Sector is Down for 2012 – Is There a Light at the End of the Tunnel?

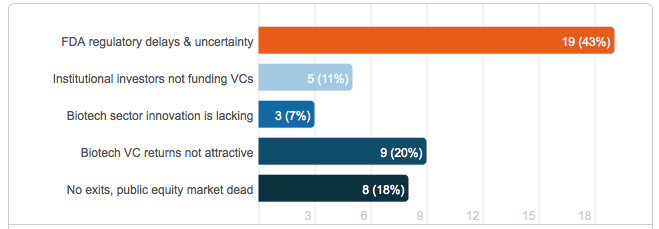

Venture capital investment in the life science sector is down both in total number of venture dollars and number of deals according to the Dollar Drought Moneytree Life Sciences Report, published this month by Price Waterhouse Cooper. The report compared venture capital investment in second quarter 2012 to second quarter 2011 and found that it had dropped 39%. In addition the number of venture capital deals were down 22%. Perhaps even worse news is that the drop in investment second quarter was not an isolated event, but instead continued a slide now standing at four quarters (see Figure 1).

Figure 1: Life Science Funding Trends by Quarter

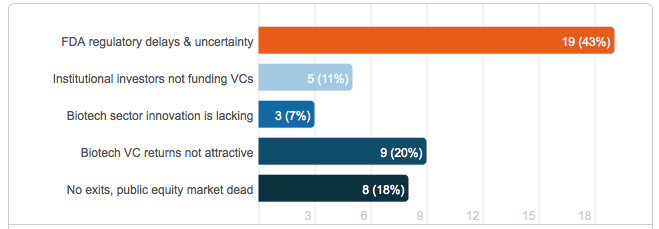

If life science venture funding is down over the past four quarters, then we have to ask why are we seeing such a decline. In the Price Waterhouse Cooper report Tracy T. Lefteroff, global managing partner of their venture capital practice said “The long time horizon often required for a liquidity event, regulatory challenges and large amount of capital often needed to fund life science companies likely contributed to this sector’s investment decline during the past four quarters.” Lefteroff’s statement is consistent with the opinion of others in the life science industry that recently weighed in on a LinkedIn poll that asked, “Why biotech investment was down in 2012 by 62% from 2011.” The results showed that most respondents felt that Food and Drug Administration (FDA) delays and uncertainty was the main cause for the drop, followed by biotech venture capital returns not attractive and no exits available, public equity market dead (please see Figure 2).

Figure 2: Results of LinkedIn Poll – Biotech VC Investment is Down to $2.76 Billion in Q2, 2012, a 62% drop from the prior year. Why?

In the LinkedIn poll, most industry respondents felt that FDA regulatory delays and uncertainty was the most prominent reason for the lack of venture capital investment. This opinion is supported by a survey published in October 2011 by the National Venture Capital Association (NVCA). The survey found that 40 percent of the 150 venture capital firms that responded have been investing less in life sciences over the past three years. The firms cite regulatory hurdles as a major reason for the reduction and plan to continue to reduce their spending over the next three years. The survey was highlighted in an article in Bloomberg Business Week titled, “Venture Firms Reduce Biotechnology Investment on FDA Risk.” In the article Terry McGuire, co-founder and general partner of Polaris Venture Partners is quoted saying that “The process has gotten to be so long, and the capital required so deep, that it’s becoming more and more difficult to generate venture-type returns and therefore make it worth your while to do it.” The article goes on to say that “venture firms have shifted their investments overseas,” where McGuire says regulatory approvals come quicker. More than one-third of survey respondents said they would increase their spending in Europe and 44 percent in Asia, compared with 13 percent saying the same for North America.

The FDA has responded to these issues and has stated publicly that they are looking at industry concerns. Commissioner Margaret Hamburg said in a recent statement that the agency plans to streamline regulations and speed up the approval process for some drugs, among other changes. According to an FDA news release dated Novmeber 3, 2011, “35 innovative new drugs were approved in fiscal year 2011, among the highest number of approvals in the past decade, surpassed only by 2009 (37).” In spite of efforts made by FDA in this area, it seems investors aren’t buying it, at least not yet.

The recently passed user fee reauthorization bill may help to bolster investor confidence when it comes to the FDA regulatory process. The bill, while raising fees for companies working through the regulatory approval process, also ensures the companies more face time with FDA and regular reviews with the goal of streamlining the process and making regulatory approvals more efficient in both time and money. In addition, the bill also provides extended market exclusivity for certain infectious disease treatments that address unmet needs. These benefits could give investors hope for a quicker approval process and in some instances, longer exclusivity and larger profits. Please see our blog “The House Passes FDA User Fee Reauthorization Bill, Senate Next,” for more information about the bill.

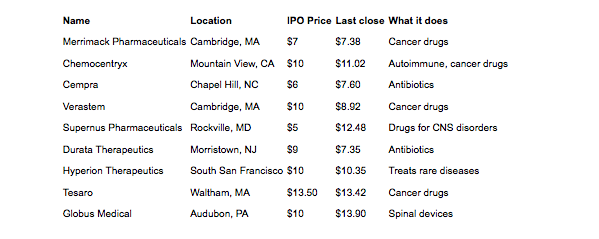

Another potential boost to investor confidence may come from the fact that biotech initial public offerings (IPOs) for 2012 have done very well. One of the top responses in the LinkedIn poll was that there was no exit available for venture capital firms that invest in biotechnology, but according to a recent article in Xconomy, “Brace Yourself: Biotech IPOs are Beating Tech’s Big Names,” by Luke Timmerman that may not be the case any longer. In the article, Timmerman explains that there have been nine biotech IPOs this year and only 12 in all of 2011. Of the nine IPOs this year six are trading above their IPO price and none have crashed (see Figure 3).

Figure 3: Biotech IPO Scorecard for 2012

The Price Waterhouse Cooper report also pointed out two additional areas where investors may see a benefit and incentive to return to biotechnology investment. The first is in the area of mergers and acquisitions (M&A), which were up 61% in the second quarter of this year versus the first quarter. “If M&A activity picks up during the second half of this year, investors should continue to see a clearer path to returns, which potentially could attract more money to be invested in this sector,” says Lefteroff.

The second opportunity comes with the New Jobs Act that could also help raise investor confidence by allowing more companies to file IPOs. The act reduces Sarbanes-Oxley requirements for five years, for companies with less than $1 billion dollars in annual revenue, thus encouraging more small biotech companies to have IPOs. Based on how biotech IPOs have performed so far in 2012, this could give investors a boost of confidence that a reasonable exit strategy is possible.

The life science sector competes with other technology companies particularly those in the information technology area including software, Internet, and recently social media companies for venture capital dollars. These companies tend to attract more venture capital funding because there are little to no regulatory hurdles, require significantly less money to operate, their life cycle is shorter, and they offer an easier and shorter path to liquidity. However, the life science sector has huge upside potential and with the recent positive developments in this area, hopefully, more venture capital firms will see their way back to biotech.